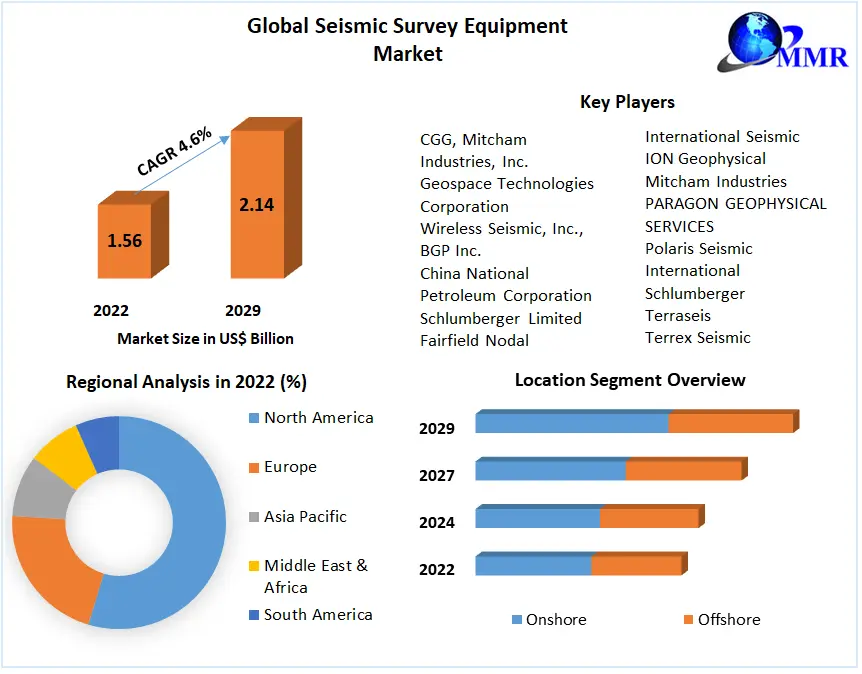

Seismic Survey Equipment Market Share was worth US$ 1.56 Bn. in 2022 and total revenue is expected to grow at a rate of 4.60 % CAGR from 2023 to 2029, reaching almost US$ 2.14 Bn. in 2029.

Market Estimation & Definition

The global Seismic Survey Equipment Market Share was valued at USD 1.56 billion in 2022 and is projected to grow at a CAGR of 4.6%, reaching approximately USD 2.14 billion by 2029. Seismic survey equipment is primarily used for geological exploration to study subsurface properties, vital for identifying and analyzing oil, gas, and mineral deposits. These tools enable the generation and detection of seismic waves, helping industries such as oil and gas, mining, and construction to make informed decisions regarding the extraction and utilization of natural resources. Seismic survey equipment includes various devices like geophones, hydrophones, air guns, and software solutions designed for advanced data processing.

Get a Free Sample PDF of this Research Report for more insights:https://www.maximizemarketresearch.com/request-sample/11659/

Market Growth Drivers & Opportunities

-

Rising Exploration & Production Activities: The increasing demand for energy, coupled with the need for better resource management, has driven the growth in exploration and production (E&P) activities across the globe. As oil and gas companies push further into untapped regions, the demand for seismic surveys to detect oil, gas, and mineral reserves continues to rise. The rapid development in Africa and Latin America, areas known for their rich energy resources, offers substantial growth opportunities for seismic survey equipment.

-

Technological Advancements in Seismic Imaging: The seismic industry is witnessing technological innovations, particularly in imaging techniques. Advances in 3D and 4D imaging allow for more precise and detailed subsurface mapping. 4D imaging, which adds the element of time to the 3D imaging process, is becoming increasingly critical for understanding how reservoirs evolve, thereby driving the adoption of advanced seismic survey equipment.

-

Offshore Exploration Expansion: Offshore seismic surveys are gaining traction, particularly in marine exploration, where large portions of untapped oil and gas reserves remain. Investments in offshore seismic survey projects are increasing, as companies seek to expand their footprint in deep-water and untapped offshore regions. This growth is particularly evident in the Middle East and parts of Asia-Pacific, where oil reserves are abundant in marine areas.

-

Government Initiatives & Exploration Contracts: Various governments, particularly in resource-rich regions, are offering incentives and subsidies to promote exploration activities. Moreover, several international contracts for seismic survey services, such as those seen in the Middle East and Latin America, have further fueled demand for seismic survey equipment.

-

Growing Demand in Mining and Construction Sectors: While oil and gas remain the largest consumers of seismic survey equipment, other industries such as mining and construction are increasingly utilizing seismic technologies for ground survey, subsurface exploration, and structural safety assessments.

Segmentation Analysis

-

By Component:

- Hardware: The hardware segment holds the largest share in the seismic survey equipment market. Hardware used in seismic surveys includes geophones, hydrophones, and seismic sources like air guns and Vibroseis. These hardware components are essential for generating seismic waves and detecting their reflections from subsurface structures. The hardware segment is expected to maintain its dominance due to the need for reliable and robust devices in data acquisition.

- Software: Seismic survey software solutions enable the processing and interpretation of seismic data collected by hardware components. The use of advanced software for data analysis, modeling, and simulation is expanding, especially in industries where precision and high-resolution data are crucial. The software segment is also growing rapidly, driven by the demand for better data management and real-time analysis.

-

By Technology:

- 2D Imaging: Traditional 2D seismic imaging is widely used for basic subsurface mapping. While it is less advanced compared to newer methods, 2D imaging is still widely adopted due to its cost-effectiveness and simpler data processing needs.

- 3D Imaging: 3D imaging technology provides a more detailed and precise understanding of subsurface formations. It is the most commonly used technique for seismic surveys, especially in the oil and gas industry, as it allows for better visualization of geological structures and more accurate assessments of resource potential.

- 4D Imaging: 4D imaging, an advanced extension of 3D technology, adds the dimension of time. This technology enables real-time monitoring of changes in subsurface formations, making it ideal for long-term reservoir management, particularly in oil and gas exploration.

Get a Free Sample PDF of this Research Report for more insights:https://www.maximizemarketresearch.com/request-sample/11659/

-

By Location:

- Onshore: Onshore seismic surveys are typically easier to conduct and more affordable compared to offshore surveys. They remain a large part of the seismic survey equipment market, especially in regions with abundant land-based oil and gas resources.

- Offshore: Offshore seismic surveys are seeing rapid growth due to the exploration of untapped oil and gas reserves beneath the ocean floor. Offshore surveys require specialized equipment due to the challenging conditions and depth of the surveys. This segment is expected to grow at the highest CAGR during the forecast period.

-

By Industrial Application:

- Oil & Gas: The oil and gas sector is the largest end-user of seismic survey equipment. It accounts for a major portion of the market as seismic surveys are essential for oil exploration and extraction. With increasing global energy demands, the oil and gas sector will continue to drive market growth.

- Mining & Construction: Other industries, such as mining and construction, are using seismic survey equipment for subsurface exploration, structural integrity assessments, and resource identification. As construction projects grow in complexity and scale, seismic surveys will play an increasing role in ensuring the stability of foundations and structures.

Country-Level Analysis

-

United States: The U.S. dominates the seismic survey equipment market, driven by its large-scale oil and gas production and exploration activities, particularly in shale reserves. The continuous growth in energy production, coupled with advancements in technology like 3D and 4D seismic imaging, positions the U.S. as a leader in the global market. Additionally, its strong presence in the mining and construction sectors further contributes to the demand for seismic survey equipment.

-

Germany: Germany plays a significant role in the European seismic survey equipment market. The country’s industrial applications, including those in construction and energy, rely heavily on seismic survey technologies. Germany’s leadership in technology development and innovation also supports the adoption of advanced seismic survey methods like 3D and 4D imaging.

-

China: As one of the largest consumers of seismic survey equipment in the Asia-Pacific region, China is seeing rapid expansion in oil and gas exploration and offshore survey projects. Its growing energy sector and increasing demand for high-resolution seismic imaging solutions contribute to the region's dominant position in the global market.

-

Middle East: The Middle East remains a key region for seismic survey equipment due to its vast untapped oil and gas reserves. With ongoing exploration activities, especially in offshore fields, the demand for seismic survey equipment in this region is expected to remain high.

For in-depth competitive analysis, buy now @:https://www.maximizemarketresearch.com/market-report/seismic-survey-equipment-market/11659/

Commutator Analysis

The seismic survey equipment market is highly competitive, with key players such as CGG, Schlumberger Limited, Geospace Technologies Corporation, Wireless Seismic, Inc., and ION Geophysical Corporation. These companies are focusing on technological innovations, expanding their product portfolios, and forging strategic partnerships to enhance their competitive advantage. The increasing trend towards automation and real-time data analysis in seismic surveys is pushing companies to innovate and offer integrated solutions that improve survey efficiency and reduce operational costs.

1. CGG, Mitcham Industries, Inc.

2. Geospace Technologies Corporation

3. Wireless Seismic, Inc., BGP Inc.

4. China National Petroleum Corporation

5. Schlumberger Limited

6.Fairfield Nodal

7. ION Geophysical Corporation

8. BGP

9. DMT

10. Geokinetics

11. Geospace Technologies