Executive Summary

The global butane market is on a steady growth trajectory, driven by expanding applications in fuel, petrochemical, and energy industries. Butane, a highly versatile hydrocarbon, plays a pivotal role in energy generation, residential cooking, industrial heating, and as a feedstock in petrochemical processes. The market is witnessing significant demand from developing economies due to rapid urbanization and the need for clean and efficient fuel alternatives.

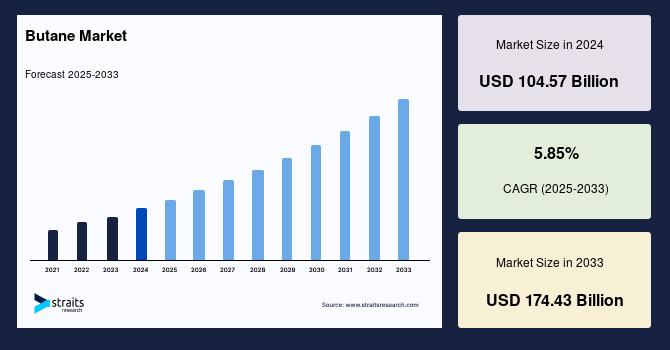

The global butane market size was valued at USD 104.57 billion in 2024. It is estimated to reach from USD 110.69 billion by 2025 to USD 174.43 billion by 2033, growing at a CAGR of 5.85% during the forecast period (2025–2033).

What is Butane?

Butane (C₄H₁₀) is a colorless, easily liquefied gas that exists primarily in two isomeric forms: n-butane and isobutane. It is a byproduct of natural gas processing and crude oil refining. As a fuel source, it is known for its clean combustion, high calorific value, and ease of transport and storage.

Butane is often used on its own or blended with propane to form Liquefied Petroleum Gas (LPG), which is widely used for heating, cooking, and industrial processes.

Key Market Drivers

1. Rising Global Demand for LPG

A significant portion of butane is consumed in the production of LPG, which is in high demand globally—especially in residential and commercial cooking, heating, and fuel applications. Developing economies in Asia and Africa are experiencing rapid increases in LPG usage due to government subsidies, urbanization, and efforts to replace traditional biomass fuels with cleaner alternatives.

2. Growth in the Petrochemical Industry

Butane serves as an essential feedstock for various petrochemical products, including butadiene, ethylene, maleic anhydride, and high-octane gasoline additives. Its use in steam cracking and alkylation processes supports the production of plastics, rubbers, and synthetic fibers. As global demand for petrochemical-based consumer goods and industrial materials rises, so does the demand for butane.

3. Cleaner Alternative for Automotive Fuel

Isobutane is increasingly being used in the production of alkylate, a clean-burning component of gasoline that improves octane levels and reduces emissions. This makes butane a valuable contributor to cleaner transportation fuels, particularly in regions pushing for reduced vehicle emissions.

4. Energy Storage and Seasonal Fuel Blending

In colder climates, butane is commonly used in seasonal gasoline blending to improve vapor pressure in winter fuels. It also plays a role in the energy storage sector, where it is used as a fuel for off-grid or backup power systems.

Market Challenges

1. Price Volatility of Raw Materials

Butane prices are closely linked to the global prices of crude oil and natural gas. Volatility in the upstream market can affect production costs, supply chain predictability, and profit margins for downstream users.

2. Environmental and Regulatory Pressures

Although cleaner than coal and biomass, butane is still a fossil fuel. Increasing global focus on carbon neutrality and stricter environmental regulations may limit its long-term use in certain applications. Restrictions on volatile organic compounds (VOCs) and efforts to phase out hydrocarbon-based propellants in aerosols are additional headwinds.

3. Infrastructure Limitations in Developing Markets

In many emerging economies, underdeveloped distribution networks, storage facilities, and handling systems hinder the efficient use and supply of butane. Without appropriate investment in logistics and safety infrastructure, market growth can be hampered despite high demand potential.

Market Segmentation

By Product Type

-

n-Butane: Widely used in LPG production, as a fuel, and in the synthesis of chemicals like butadiene.

-

Isobutane: Used primarily in alkylation processes to produce high-octane gasoline and in aerosol propellants.

By Application

-

Liquefied Petroleum Gas (LPG)

-

Dominant application globally.

-

Used in cooking, heating, water boilers, industrial furnaces, and automotive fuel.

-

-

Petrochemicals and Refining

-

Acts as a feedstock in the production of synthetic rubbers, plastics, and resins.

-

Utilized in isomerization and alkylation to create higher-value fuels.

-

-

Aerosol Propellants

-

Butane is used in cosmetic sprays, household cleaners, and pharmaceuticals.

-

Faces environmental scrutiny but continues to be favored for its volatility and low cost.

-

-

Refrigerants and Fuel Gas

-

Used in small-scale refrigeration and as lighter fuel.

-

Applicable in camping, mobile heating systems, and off-grid energy setups.

-

Regional Market Insights

Asia-Pacific

Asia-Pacific dominates the global butane market and is also the fastest-growing region. Key growth factors include:

-

High population density and urbanization driving residential fuel consumption.

-

Large-scale LPG adoption initiatives by governments (especially in India, China, and Indonesia).

-

Strong demand from petrochemical hubs in China, South Korea, and Southeast Asia.

The region benefits from abundant natural gas resources, cost-effective labor, and expanding refinery capacities.

North America

North America holds a significant share of the global butane market due to:

-

A strong natural gas liquids (NGL) supply.

-

High per capita energy consumption.

-

Advanced infrastructure for processing, storage, and distribution.

The U.S. is a major exporter of butane, particularly to Latin America and Asia.

Europe

Europe exhibits steady but slower growth due to:

-

Strict environmental regulations.

-

Growing focus on renewable energy alternatives.

-

A mature petrochemical industry with stable demand for alkylate production.

However, ongoing investments in energy efficiency and gas storage continue to support demand.

Latin America and Middle East & Africa (MEA)

These regions are in the early stages of adopting butane-based solutions but offer significant growth opportunities due to:

-

Rising population and urban development.

-

Increasing access to clean cooking fuels.

-

Investments in infrastructure and petrochemical processing.

Countries like Brazil, Mexico, South Africa, and UAE are key emerging markets.

Competitive Landscape

The butane market is moderately consolidated, with several global and regional players actively expanding their capacities and engaging in trade agreements to secure market share.

Leading Companies Include:

-

Chevron Corporation

-

ExxonMobil Corporation

-

Royal Dutch Shell

-

TotalEnergies SE

-

BP p.l.c.

-

Sinopec Group

-

Linde plc

-

ConocoPhillips

-

Phillips 66

-

Indian Oil Corporation

These companies are focused on:

-

Strategic partnerships and joint ventures.

-

Expanding liquefied gas export facilities.

-

Investing in downstream petrochemical integration.

Recent Industry Developments

-

Several major players have shifted their focus toward the export of butane and LPG from North America to meet rising demand in Asia-Pacific and Africa.

-

There has been a consolidation in the midstream sector, with companies exiting high-risk segments such as butane trading and optimization.

-

In response to evolving environmental policies, manufacturers are exploring cleaner blending methods and better recovery systems to reduce emissions.

Future Outlook

The future of the butane market looks promising, particularly in regions with growing populations, industrialization, and energy needs. While alternative energy sources are expanding, butane’s versatility, efficiency, and relatively clean combustion characteristics will ensure its continued relevance—especially as a transition fuel in developing economies.

Increased demand from the automotive, construction, and energy sectors will drive innovation in product formulation, storage technologies, and logistics. Companies that focus on cost-efficiency, emissions management, and safety will be best positioned to capture future market share.