Market Overview

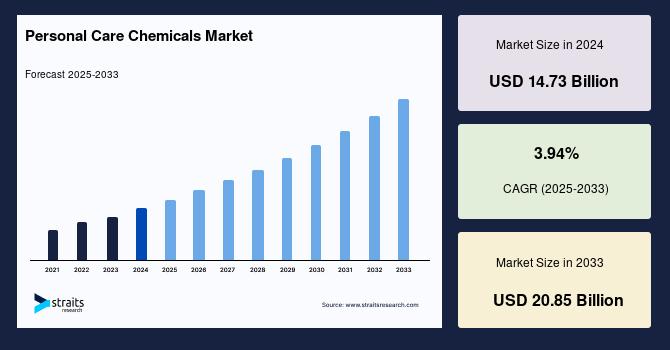

The Personal Care Chemicals Market size was valued at USD 14.73 Billion in 2024. It is projected to reach from USD 15.31 Billion by 2025 to USD 20.85 Billion by 2033, growing at a CAGR of 3.94% during the forecast period (2025–2033).

This growth is underpinned by increasing consumer awareness of personal hygiene, the rising popularity of premium beauty products, clean-label trends, and rapid innovations in cosmetic science. Expanding middle-class populations in emerging economies, along with evolving consumer preferences for natural and organic products, are also contributing significantly to market expansion.

Market Segmentation

By Ingredient Type

The personal care chemicals market is segmented into several key ingredient categories, including:

-

Emollients: These are used to moisturize and soften the skin and hold the largest share of the market due to their widespread use in skincare and haircare products.

-

Surfactants: Essential for cleansing products such as shampoos, body washes, and facial cleansers.

-

Rheology Modifiers: Used to improve product texture, stability, and application.

-

Emulsifiers: Help in the stable blending of oil and water-based ingredients.

-

Conditioning Polymers: Common in hair conditioners and skin lotions to improve texture and feel.

Among these, emollients dominate the market due to their high usage rate in moisturizing products and their essential role in daily-use skincare routines.

By Source

-

Synthetic Chemicals: These remain the most commonly used due to their cost-effectiveness, wide availability, and consistent quality. They are used in mass-market products and formulations where specific performance is required.

-

Organic/Natural Chemicals: This segment is rapidly gaining popularity as consumers increasingly demand sustainable, biodegradable, and skin-friendly alternatives. Products based on plant extracts, essential oils, and naturally-derived actives are gaining traction.

The balance between synthetic and organic ingredients continues to shift in favor of organic options, especially in premium and luxury product lines.

By Application

-

Skincare: The largest and fastest-growing segment, driven by the global obsession with youthful, radiant skin. Products like anti-aging creams, moisturizers, serums, and sunscreens fuel this demand.

-

Haircare: Includes shampoos, conditioners, hair oils, and styling products. Increasing cases of hair thinning, scalp conditions, and demand for natural formulations are boosting this segment.

-

Cosmetics: Makeup products including foundations, primers, and setting sprays are now being formulated with skin-beneficial ingredients, merging beauty with skincare.

-

Oral Care: Growing awareness around dental hygiene, whitening products, and natural toothpaste drives growth in this category.

-

Others: Includes deodorants, fragrances, grooming products, and baby care items.

Market Drivers

1. Rising Consumer Demand for Clean and Green Beauty

The modern consumer is highly aware of what goes into personal care products. There is a growing preference for:

-

Non-toxic, non-irritating ingredients

-

Plant-based and biodegradable formulas

-

Free-from claims (e.g., sulfate-free, paraben-free, cruelty-free)

This demand is encouraging manufacturers to reformulate existing product lines and launch new “clean beauty” ranges, spurring demand for safe and sustainable chemical ingredients.

2. Technological Innovations in Formulation

Advancements in biotechnology, nanotechnology, and green chemistry have led to the development of new and improved personal care chemicals. These innovations offer:

-

Enhanced delivery systems for actives (e.g., liposomes, encapsulation)

-

Longer shelf life

-

Improved sensory experience (texture, absorption, fragrance)

-

Smart ingredients that respond to skin conditions or environmental changes

This continuous innovation enhances product effectiveness and consumer appeal.

3. Expanding Middle Class and Urbanization

As economies develop, especially in regions like Asia-Pacific, Latin America, and the Middle East, an increasing portion of the population has access to disposable income. This fuels the demand for:

-

Premium personal care and cosmetic products

-

Imported and branded skincare

-

Daily grooming and self-care routines

Consumers are also becoming more brand-conscious and willing to pay a premium for products that offer functional and aesthetic value.

4. Growth of E-commerce and Digital Beauty Platforms

Online shopping and direct-to-consumer beauty brands have exploded in recent years. Consumers are now more exposed to niche and specialty brands that use unique personal care ingredients. This has:

-

Democratized access to global beauty trends

-

Increased consumer education on ingredients and efficacy

-

Allowed startups to disrupt the market with clean, functional formulations

Market Challenges

1. Regulatory Compliance and Safety Standards

Personal care chemicals are subject to stringent regulations across different regions. Manufacturers must ensure:

-

Ingredient safety and toxicological testing

-

Compliance with labeling requirements

-

Traceability of raw materials

This increases operational complexity and can delay time-to-market for new products, especially in regions with tight restrictions like the EU and the US.

2. Volatility in Raw Material Prices

Price fluctuations in petrochemical-based ingredients, essential oils, and natural extracts can severely affect production costs. Climate change and geopolitical tensions also impact the availability and pricing of natural resources, adding unpredictability to the supply chain.

3. Consumer Skepticism Toward Synthetic Ingredients

There is a growing skepticism around synthetic chemicals, especially those perceived as harmful (e.g., sulfates, parabens, phthalates). Even safe and approved ingredients may be rejected by consumers based on public perception. This forces companies to rethink ingredient strategies and invest in education and transparency.

Regional Insights

North America

North America is a mature yet dynamic market for personal care chemicals. Growth is driven by:

-

Innovation in cosmeceuticals and dermatology-focused skincare

-

Demand for multifunctional and anti-aging products

-

A strong emphasis on natural and organic personal care products

Europe

Europe is a significant contributor to global market share, with countries like Germany, France, and the UK leading the way. Trends here include:

-

Strict compliance with EU Cosmetic Regulation

-

High demand for vegan and cruelty-free products

-

Sophisticated consumer base prioritizing product performance and sustainability

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea. Factors driving growth include:

-

A large young population eager for cosmetic and personal grooming products

-

Rising urbanization and income levels

-

Booming local beauty industries and international brand penetration

Rest of the World (Latin America, Middle East & Africa)

These regions are witnessing moderate but steady growth due to:

-

Increasing awareness of hygiene and grooming

-

Expansion of retail and e-commerce networks

-

Local production of affordable personal care brands

Competitive Landscape

The personal care chemicals market is moderately consolidated, with several global players holding strong positions. Key strategies include:

-

Strategic mergers and acquisitions to expand product portfolios

-

Investment in green chemistry and sustainable ingredient development

-

Collaborations with cosmetic brands and research institutes

-

Focus on regional expansion, especially in emerging markets

Major companies in the market include:

-

BASF SE

-

Dow

-

Solvay

-

Evonik Industries

-

Clariant

-

Ashland

-

Croda International

-

Lonza

-

Wacker Chemie

-

Galaxy Surfactants

-

Kao Corporation

-

Lubrizol

-

DSM

-

Givaudan

These companies are actively engaged in innovation, product launches, and capacity expansion to meet the changing demands of the market.

Future Outlook

The personal care chemicals market is poised for significant transformation over the next decade. Key future trends include:

-

Rise of multifunctional ingredients: Consumers prefer products that do more—e.g., moisturize, protect, and repair—resulting in higher demand for versatile ingredients.

-

Biotechnology-driven formulations: Lab-grown ingredients, bio-fermented actives, and microbial-derived chemicals will gain prominence.

-

Hyper-personalization: AI-powered skincare diagnostics and tailored ingredient combinations will redefine consumer experiences.

-

Circular beauty: Emphasis will grow on refillable packaging, zero-waste processes, and closed-loop ingredient sourcing.

As sustainability and science converge, the role of personal care chemicals will become even more critical in developing the next generation of beauty and hygiene products.

Conclusion

The global personal care chemicals market is evolving rapidly—shaped by innovation, changing consumer preferences, and a strong push for sustainability. While challenges such as regulatory compliance and ingredient scrutiny exist, the industry’s forward momentum remains intact. As consumers continue to prioritize self-care, wellness, and eco-conscious choices, the demand for high-performance and ethically produced personal care chemicals will only grow stronger.