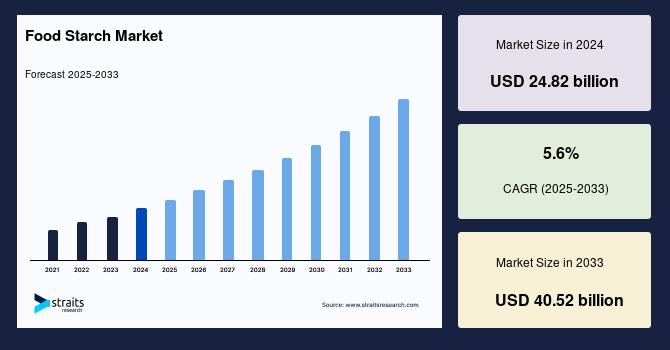

The global food starch market size was valued at USD 24.82 billion in 2024. It is estimated to reach from USD 26.21 billion in 2025 to USD 40.53 billion by 2033, growing at a CAGR of 5.6% during the forecast period (2025–2033).

Key Market Drivers

1. Growth of the Food & Beverage Industry

The ongoing expansion of the global food and beverage industry remains the most prominent driver of the food starch market. With rapid urbanization, rising disposable incomes, and increasing demand for processed and convenience foods, manufacturers are turning to starches as essential components for texture, stability, and shelf-life improvement in a wide range of food products.

2. Functional and Technological Advancements

Food starches are no longer used merely as thickeners. Today, they serve multiple functions, including emulsification, fat replacement, moisture retention, and film formation. Technological advancements have led to the development of modified starches that cater to specific industrial and consumer needs, enhancing performance in extreme temperatures, acidic conditions, and freezing-thawing cycles.

3. Rising Demand for Plant-Based and Clean-Label Products

Consumer preference is shifting toward natural and clean-label ingredients. This trend has fueled the demand for starches derived from non-GMO and plant-based sources like pea, tapioca, rice, and potato. Clean-label starches that perform similarly to chemically modified starches, without synthetic additives, are becoming mainstream, especially in premium and health-oriented food products.

Market Restraints

Despite strong growth prospects, the market faces certain challenges. One major restraint is growing consumer awareness about the nutritional drawbacks of excessive starch consumption. Starches are high in carbohydrates and lack essential nutrients such as protein, vitamins, and fats. Overconsumption may contribute to weight gain, insulin resistance, and other metabolic concerns.

Additionally, price fluctuations of raw materials, especially corn and wheat, impact production costs and profitability. Regulatory pressures around food additives and labeling also pose hurdles for manufacturers working with modified starches.

Emerging Opportunities

Clean-Label and Specialty Starches

Clean-label starches are expected to play a crucial role in market expansion. These starches meet consumer demand for transparent, recognizable ingredients and are increasingly used in organic and minimally processed foods.

Expansion into New Applications

Starch usage is expanding beyond food into pharmaceuticals, cosmetics, and nutraceuticals. In cosmetics, starch provides absorbent and mattifying properties. In pharmaceuticals, it functions as a binder and disintegrant. This cross-industry application is opening up new revenue streams for producers.

Regional Market Insights

Asia-Pacific

Asia-Pacific leads the global food starch market, both in consumption and production. Driven by a booming food processing industry, growing middle-class population, and increasing adoption of Western eating habits, countries like China, India, Indonesia, and Thailand are experiencing strong demand for starch in snacks, bakery items, and dairy products. The region is also a major producer of raw materials such as cassava, rice, and maize.

North America

North America holds a significant share of the market, supported by a mature food processing sector and rising interest in gluten-free and clean-label food products. The region is witnessing steady growth in specialty starches and plant-based alternatives.

Europe

Europe’s food starch market is characterized by advanced processing technologies, high regulatory standards, and increasing demand for sustainable and organic ingredients. The region also invests heavily in research and development, particularly in the development of functional starches and sugar alternatives.

Latin America, Middle East, and Africa (LAMEA)

These emerging markets are gradually increasing their footprint in the global starch industry. While growth is relatively slower, abundant availability of agricultural raw materials and improving food processing infrastructure are expected to drive future demand.

Market Segmentation

By Raw Material

-

Corn (Maize) – Dominates the global market due to its availability and versatility.

-

Wheat – Common in Europe and Asia, valued for its texture properties.

-

Potato – Popular in Europe and used for its neutral taste and excellent gelling characteristics.

-

Tapioca and Others – Gaining popularity due to their gluten-free and clean-label appeal.

By Type

-

Native Starch – Used in traditional recipes and minimally processed foods.

-

Modified Starch – Offers improved stability and functionality for industrial applications.

-

Sweeteners (Dextrose, Glucose Syrups, HFCS) – High demand from the confectionery and beverage sectors.

By Application

-

Food & Beverage – The primary end-use sector, with applications in bakery, dairy, beverages, sauces, and snacks.

-

Animal Feed – Growing use of starches in animal nutrition for energy supply.

-

Pharmaceutical & Cosmetic – Emerging segment, particularly in developing markets.

By End User

-

Business-to-Business (B2B) – Dominates the market, with starch used by food manufacturers, pharmaceutical companies, and cosmetic producers.

-

Business-to-Consumer (B2C) – Smaller segment, but growing due to home baking, gluten-free diets, and DIY food kits.

Competitive Landscape

The global food starch market is moderately consolidated, with several key players holding a significant market share. Companies are investing in capacity expansions, clean-label innovations, and strategic acquisitions to enhance their market presence.

Key Players

-

Archer Daniels Midland (ADM)

-

Cargill Incorporated

-

Ingredion Incorporated

-

Tate & Lyle PLC

-

Roquette Frères

-

Beneo GmbH

-

AGRANA Beteiligungs-AG

-

SPAC Starch Products India

-

Sonish Starch Technology

-

Nutrend Biotech Co., Ltd.

These players are focusing on launching innovative starch-based solutions, expanding into emerging markets, and improving supply chain resilience.

Future Outlook

The future of the food starch market looks promising. As consumers demand more functional, natural, and sustainable ingredients, manufacturers will continue to develop advanced starches to meet these expectations. Clean-label and specialty starches will lead the next wave of innovation, while the rise in plant-based and gluten-free diets will further support long-term demand.

With continued investment in R&D and expansion into non-food applications, the food starch market is poised for substantial growth, driven by a blend of tradition, innovation, and evolving global dietary trends.