Molybdenum‑99 (Mo‑99) is a vital radioisotope at the heart of modern diagnostic medicine. Through its decay into technetium‑99m (Tc‑99m) used in more than 80% of nuclear imaging procedures worldwide it underpins scans for heart, bone, and tumor diseases. Given its short half-life of roughly 66 hours and sensitive supply chain, ensuring reliable Mo‑99 production has become a critical imperative for global healthcare systems.

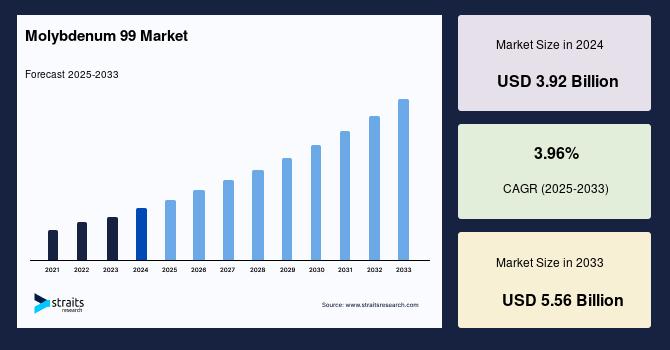

Market Size & Forecast

The global molybdenum 99 market size was valued at USD 3.92 billion in 2024 and is projected to grow from USD 4.07 billion in 2025 to USD 5.56 billion by 2033, growing at a CAGR of 3.96% during the forecast period (2025-2033). The growth of the market is attributed to increasing prevalence of chronic diseases.

Core Market Drivers

-

Growing Need for Diagnostic Imaging

As global populations age and chronic illnesses rise, demand for early and accurate diagnostic tools has surged. Tc‑99m's dominance in nuclear medicine owing to its favorable properties fuels a foundational need for Mo‑99. -

Regulatory & Non-Proliferation Momentum

The medical isotope industry is transitioning away from highly enriched uranium (HEU) toward low-enriched uranium (LEU) production, aligning with non-proliferation policies. LEU now dominates Mo‑99 production, accounting for over 90% of output. -

Technological Innovation and New Production Methods

Traditional reactor-based supply remains critical, yet fragile. To mitigate risk, investments are pouring into accelerator-, cyclotron-, and neutron-capture-based production technologies offering safer, decentralized, and more sustainable supply chains. -

Expansion of Nuclear Medicine Infrastructure

Emerging healthcare markets, particularly in Asia and Latin America, are rapidly expanding diagnostics capacity. Governments and private providers are investing in infrastructure and radiopharmaceutical access, fueling Mo‑99 demand.

Challenges & Market Vulnerabilities

-

Concentrated Supply Base

A handful of aging nuclear reactors produce the vast majority of Mo‑99 globally. Any unexpected shutdown or maintenance can trigger global shortages of Tc‑99m, disrupting patient care. -

Logistical Hurdles

With Mo‑99’s half-life so short, it must be produced and shipped under tight timelines. Complex licensing and cross-border coordination add layers of risk to distribution. -

High Capital & Regulatory Barriers

Setting up compliant production facilities especially for alternative methods demands heavy investments and long development cycles, slowing market entry.

Shifting Production Landscape

The stakes of supply disruption were highlighted recently when an offline reactor in Europe led to widespread cancellation of medical scans underscoring the need for more resilient production systems.

Responding to these vulnerabilities, initiatives like new US-based accelerator facilities and projects using fusion-powered neutron generation are underway aiming to produce millions of doses annually from non-reactor sources. Government funding, such as grants supporting domestic LEU production, is accelerating these shifts.

Applications and Segmentation

-

Medical Imaging (Dominant Application)

SPECT imaging using Tc‑99m generated from Mo‑99 remains the primary use. Growing demands in cardiac, oncology, and neurology scans drive much of the volume. -

Medical Research & Radiopharmaceutical Production

Mo‑99 supports research and development of new diagnostic agents and therapeutic protocols, expanding its utility beyond routine imaging. -

Industrial & Research Uses

Though smaller, Mo‑99 finds use in non-destructive testing, scientific research, and tracer studies in material science and nuclear physics.

Regional Market Dynamics

-

North America

Largest regional consumer. Despite lacking domestic reactor-based Mo‑99 production, investments in new LEU facilities and accelerating alternative methods are reshaping its supply outlook. -

Europe

A forward-moving player, adopting LEU standards swiftly and investing in resilient supply models while tightly regulating use. -

Asia-Pacific

Fastest-growing region; booming nuclear medicine infrastructure, rising healthcare spending, and public health needs drive demand for Mo‑99. -

Latin America and Middle East/Africa

Emerging markets making inroads through new diagnostics centers and government-supported isotope strategies.

Future Outlook & Strategic Trends

1. Decentralized, Non-Reactor Production Growth

Accelerators and cyclotrons promise safer, flexible local production models. This trend is gaining traction, with several pilot facilities slated to vastly expand supply volumes in the next few years.

2. Public-Private Partnerships & Long-Term Contracts

Supply agreements between medical providers and isotope producers offer demand stability. Several governments and hospital networks are securing contracts to guarantee consistent access to Mo‑99.

3. Digital Supply Chain Optimization

Advanced analytics and forecasting tools are helping align production with real-time usage patterns reducing waste and improving delivery rhythms.

4. Sustainability and Safety Enhancements

Facilities are shifting toward LEU and cleaner processes, reducing proliferation risk and environmental impact. This makes Mo‑99 production safer and more socially acceptable.

Conclusion

Success in this sector hinges on investment in alternative production technologies, resilient supply chains, regulatory compliance, and digital optimization. Nations and organizations that lead these strategic shifts will not only improve healthcare access but also safeguard millions of diagnostic procedures worldwide.