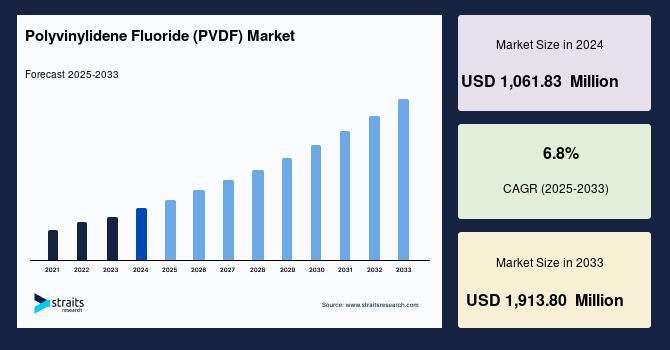

The global polyvinylidene fluoride (PVDF) market size was valued at USD 1,061.83 million in 2024 and is projected to reach from USD 1,128.2 million in 2025 to USD 1,913.80 million by 2033, growing at a CAGR of 6.8% during the forecast period (2025-2033). This growth trajectory is propelled by expanding applications across diverse sectors including electronics, energy storage, automotive, aerospace, construction, and chemical processing.

What is Polyvinylidene Fluoride?

Polyvinylidene fluoride (PVDF) is a high-performance thermoplastic fluoropolymer known for its distinctive durability, excellent chemical resistance, and ability to withstand extreme environmental conditions. It is widely utilized in manufacturing due to its ability to maintain mechanical and chemical integrity under harsh conditions, including high temperatures, chemical exposure, and radiation.

Market Growth Drivers

Several key factors are fueling the expansion of the PVDF market:

-

Rapid Adoption in Electric Vehicles (EVs) and Energy Storage:

PVDF plays a pivotal role as a binder material in lithium-ion batteries, which are central to the EV revolution. Its strong adhesion properties, electrochemical stability, and thermal resistance enhance battery performance and safety, making it indispensable in the growing renewable energy and automotive sectors. -

Expanding Applications in Construction:

PVDF’s superior resistance to weathering, UV radiation, and corrosion makes it ideal for use in construction materials such as architectural films, coatings, and membranes. Its ability to endure extreme weather conditions such as heavy rain, strong winds, and temperature fluctuations ensures lasting protection and durability for buildings. -

Chemical Processing Industry Demand:

The chemical processing sector utilizes PVDF extensively for pipes, fittings, valves, and linings due to its ability to resist corrosion from acids, solvents, and gases. It offers operational safety, reduces maintenance costs, and extends equipment lifespan, making it a preferred material in harsh industrial environments. -

Sustainability and Regulatory Support:

Increasing focus on sustainability and environmental standards, such as those set by the Leadership in Energy and Environmental Design (LEED), encourages the use of durable, recyclable, and low-emission materials like PVDF in construction and manufacturing.

Diverse Industry Applications

The PVDF market spans across multiple industries, each benefiting from the polymer’s inherent qualities:

-

Electronics and Semiconductor:

PVDF films and sheets serve as dielectric materials and protective coatings, enabling high-performance electronics with improved reliability and efficiency. -

Energy and Renewable Sector:

Its key role in lithium-ion batteries for electric vehicles and energy storage solutions drives significant demand. Moreover, PVDF is gaining prominence in perovskite solar cells, improving power conversion efficiency through its dielectric properties. -

Automotive and Aerospace:

Lightweight and chemically resistant PVDF composites enhance vehicle safety components, fuel systems, and structural parts while contributing to weight reduction, crucial for fuel efficiency and emissions reduction. -

Healthcare and Medical Devices:

PVDF’s biocompatibility and chemical inertness make it suitable for various medical applications including membranes, tubing, and coatings for devices requiring sterilization and chemical resistance. -

Construction and Building Materials:

Its use in membranes, architectural coatings, and composite materials ensures weather-resistant, long-lasting infrastructure able to withstand environmental stressors.

Regional Market Insights

-

North America:

This region leads the PVDF market, supported by advanced manufacturing, robust automotive and aerospace industries, and strong investments in green technologies. The U.S. dominates with significant usage of PVDF in semiconductor manufacturing, renewable energy, and chemical processing. -

Europe:

Europe is one of the fastest-growing markets, driven by Germany and France’s strong industrial base and governmental pushes towards sustainability and low-emission manufacturing. Research initiatives encourage the development of innovative PVDF-based applications. -

Asia-Pacific:

Asia-Pacific holds a substantial market share due to growing industrialization, expanding automotive and construction sectors, and increasing consumer electronics production in China, India, Japan, and South Korea. The region offers significant opportunities as demand for PVDF continues to rise with economic development. -

Other Regions:

Latin America, the Middle East, and Africa are emerging markets, gradually adopting PVDF in infrastructure and industrial applications, though at a slower pace relative to developed regions.

Challenges in the Market

Despite strong growth, the PVDF market faces challenges such as:

-

Supply Chain Disruptions:

Geopolitical tensions, trade route vulnerabilities, and environmental regulations impact the steady supply of PVDF raw materials, contributing to price volatility and delivery uncertainties. -

High Production Costs:

Advanced production technologies and raw material expenses make PVDF relatively costlier than conventional polymers, which can limit uptake in cost-sensitive sectors. -

Environmental and Regulatory Pressures:

Although PVDF is relatively eco-friendly, continuous efforts are needed to develop bio-based feedstocks and minimize emissions during manufacturing to fully meet global sustainability goals.

Industry Innovations and Future Outlook

Leading players such as Arkema are investing heavily in research and development to enhance PVDF formulations, targeting broader applications including bio-compatible materials and advanced composites. Developments aimed at improving process efficiency, sustainability, and performance characteristics continue to expand PVDF’s industrial relevance.

The rising demand for electric vehicles and renewable energy storage systems presents a vast opportunity for PVDF, given its critical function in lithium-ion battery technologies. Regulatory support through initiatives like the European Union’s Fit for 55 and the U.S. Inflation Reduction Act further accelerates market growth.

Looking ahead, continuous innovation, sustainability focus, and geographical market expansion will be pivotal to the PVDF industry’s evolution. By 2033, the market is poised to nearly double in size, fueled by expanding applications and global shifts towards cleaner energy and durable materials.

Conclusion

The polyvinylidene fluoride market stands at a promising crossroads of technological advancement and environmental responsibility. Its unique combination of chemical resistance, mechanical strength, and thermal stability makes it indispensable across industries from automotive and aerospace to energy and construction. With growing adoption in electric vehicles, renewable energy, and sustainable construction materials, PVDF’s market outlook is robust, supported by innovation and global industrial trends aimed at achieving greater efficiency and sustainability.

This presents ample opportunities for manufacturers, suppliers, and end-users to capitalize on PVDF’s strengths and contribute to the advancement of high-performance, eco-friendly solutions for a wide array of demanding applications.