In the ever-evolving world of business, managing financial data efficiently is crucial for success. Companies, regardless of their size, need robust systems to handle their accounting processes. One such system that has gained immense popularity over the years is the oracle accounting system. Known for its reliability, scalability, and comprehensive features, Oracle has become a go-to solution for businesses looking to streamline their financial operations. This article delves into the intricacies of the Oracle Accounting System, exploring its features, benefits, and why it stands out in the competitive landscape of financial software.

Understanding the Oracle Accounting System

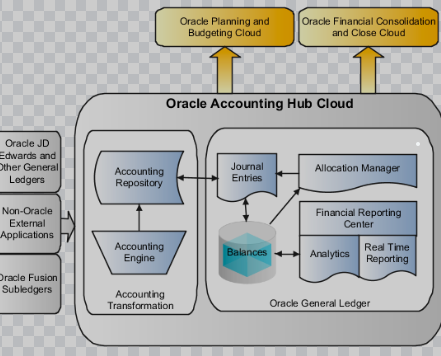

The Oracle Accounting System is a part of the larger Oracle ecosystem, which offers a wide range of enterprise resource planning (ERP) solutions. Specifically designed to handle financial management, this system provides tools for managing general ledgers, accounts payable, accounts receivable, fixed assets, and more. It is a comprehensive solution that caters to the diverse needs of modern businesses, ensuring that financial data is accurate, up-to-date, and easily accessible.

One of the key aspects of the Oracle Accounting System is its ability to integrate seamlessly with other Oracle applications. This integration allows businesses to have a unified view of their operations, making it easier to make informed decisions. Whether it’s managing cash flow, tracking expenses, or generating financial reports, the Oracle Accounting System offers a suite of tools that simplify complex accounting tasks.

Key Features of the Oracle Accounting System

The Oracle Accounting System is packed with features that make it a powerful tool for financial management. One of its standout features is the General Ledger module, which serves as the backbone of the system. This module allows businesses to record all financial transactions in a centralized database, ensuring that data is consistent and accurate. The General Ledger also supports multiple currencies, making it ideal for businesses with global operations.

Another important feature is the Accounts Payable module, which helps businesses manage their outgoing payments. This module automates the process of invoice processing, payment scheduling, and vendor management, reducing the risk of errors and improving efficiency. Similarly, the Accounts Receivable module streamlines the process of managing incoming payments, ensuring that businesses get paid on time.

The Oracle Accounting System also includes a Fixed Assets module, which helps businesses manage their physical assets. This module tracks the depreciation of assets, calculates taxes, and generates reports, making it easier for businesses to comply with regulatory requirements. Additionally, the system offers robust reporting and analytics tools, allowing businesses to generate detailed financial reports and gain insights into their financial performance.

Benefits of Using the Oracle Accounting System

The Oracle Accounting System offers numerous benefits to businesses, making it a preferred choice for financial management. One of the primary advantages is its scalability. Whether a business is small, medium, or large, the Oracle Accounting System can be tailored to meet its specific needs. This scalability ensures that the system can grow with the business, providing long-term value.

Another significant benefit is the system’s ability to improve accuracy and reduce errors. By automating many of the manual processes involved in accounting, the Oracle Accounting System minimizes the risk of human error. This not only ensures that financial data is accurate but also saves time and resources that would otherwise be spent on correcting mistakes.

The Oracle Accounting System also enhances compliance with regulatory requirements. With its robust reporting and analytics tools, businesses can easily generate the reports needed to comply with local, national, and international regulations. This is particularly important for businesses operating in multiple jurisdictions, where compliance requirements can be complex and varied.

In addition to these benefits, the Oracle Accounting System offers improved visibility into financial data. With real-time access to financial information, businesses can make informed decisions quickly. This visibility is crucial for managing cash flow, forecasting future financial performance, and identifying potential issues before they become major problems.

Why Oracle Accounting System Stands Out

In a market flooded with accounting software options, the Oracle Accounting System stands out for several reasons. One of the key differentiators is its integration capabilities. The system is designed to work seamlessly with other Oracle applications, as well as third-party software. This integration ensures that businesses have a unified view of their operations, making it easier to manage finances and other aspects of the business.

Another factor that sets the Oracle Accounting System apart is its focus on innovation. Oracle is known for its commitment to staying ahead of the curve when it comes to technology. The company regularly updates its software to incorporate the latest advancements, ensuring that businesses have access to cutting-edge tools and features.

The Oracle Accounting System also stands out for its user-friendly interface. While the system is packed with advanced features, it is designed to be intuitive and easy to use. This ensures that businesses can get up and running quickly, without the need for extensive training or technical expertise.

Finally, the Oracle Accounting System is backed by Oracle’s reputation for reliability and security. With decades of experience in the software industry, Oracle has built a reputation for delivering high-quality, secure solutions. Businesses can trust that their financial data is safe and secure when using the Oracle Accounting System.

Implementing the Oracle Accounting System

Implementing the Oracle Accounting System is a significant undertaking, but the benefits far outweigh the challenges. The first step in the implementation process is to assess the business’s needs and determine which modules and features are required. This assessment will help ensure that the system is tailored to meet the specific needs of the business.

Once the requirements have been identified, the next step is to configure the system. This involves setting up the General Ledger, Accounts Payable, Accounts Receivable, and other modules, as well as integrating the system with other applications. It is important to work with experienced professionals during this phase to ensure that the system is set up correctly.

Training is another critical component of the implementation process. While the Oracle Accounting System is user-friendly, it is important to provide training to employees to ensure that they are comfortable using the system. This training should cover not only the basics of using the system but also more advanced features and functionalities.

Finally, it is important to conduct thorough testing before going live with the system. This testing should include both functional testing, to ensure that the system is working as expected, and user acceptance testing, to ensure that the system meets the needs of the business. Once testing is complete, the system can be rolled out to the entire organization.

Conclusion

The Oracle Accounting System is a powerful tool for financial management, offering a wide range of features and benefits that make it a preferred choice for businesses of all sizes. From its scalability and integration capabilities to its focus on innovation and user-friendly interface, the oracle accounting system stands out in the competitive landscape of financial software. By implementing this system, businesses can streamline their accounting processes, improve accuracy, and gain valuable insights into their financial performance. Whether you are a small business looking to simplify your accounting processes or a large enterprise with complex financial needs, the Oracle Accounting System is a solution worth considering.