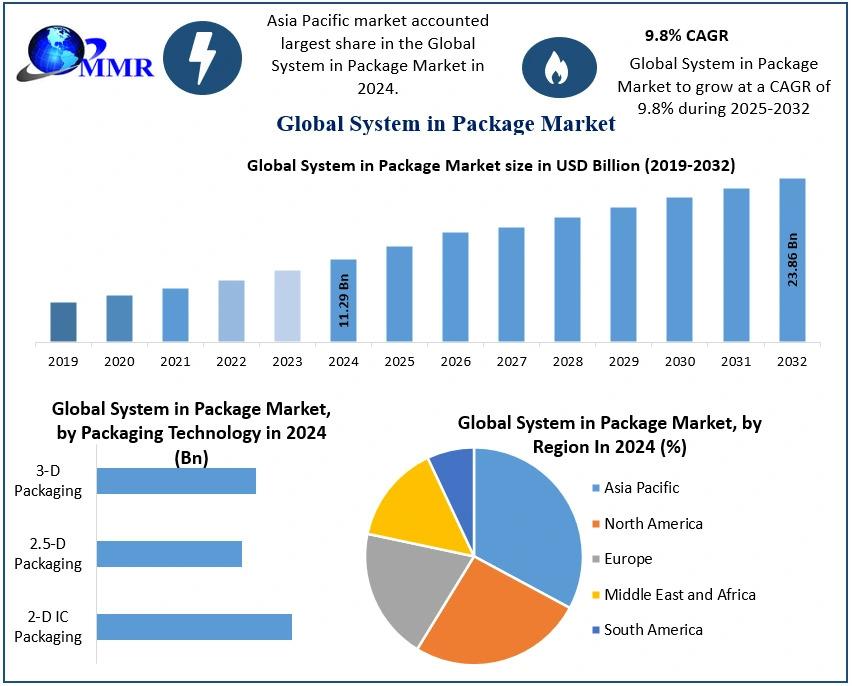

The System in Package Market Size was valued at USD 11.29 Billion in 2024 and the total System in Package revenue is expected to grow at a CAGR of 9.8% from 2025 to 2032, reaching nearly USD 23.86 Billion.

Market Definition and Overview

System in Package Market Size technology integrates multiple integrated circuits (ICs) within a single package or module, allowing for the combination of various functionalities such as memory, logic, and radio frequency (RF) components. This integration facilitates the development of compact electronic devices without compromising performance, making SiP a preferred solution in applications requiring miniaturization and enhanced functionality.

Get a Free Sample PDF of this Research Report for more insights:https://www.maximizemarketresearch.com/request-sample/7185/

Market Growth Drivers and Opportunities

Several factors are propelling the growth of the SiP market:

-

Miniaturization of Electronic Devices: The trend towards smaller, more portable electronic devices has heightened the need for compact packaging solutions. SiP technology addresses this demand by enabling the integration of multiple functionalities into a single, space-saving package.

-

Advancements in Semiconductor Technologies: Continuous innovations in semiconductor fabrication and packaging techniques have enhanced the performance and reliability of SiP solutions. These advancements have expanded the applicability of SiP across various sectors, including consumer electronics, automotive, and telecommunications.

-

Emergence of IoT and 5G Technologies: The proliferation of Internet of Things (IoT) devices and the rollout of 5G networks require highly integrated, efficient, and compact components. SiP technology offers the necessary integration and performance characteristics to meet these requirements, thereby driving market growth.

-

Cost Efficiency and Time-to-Market Advantages: SiP solutions can reduce development cycles and costs by integrating pre-tested components, simplifying design processes, and facilitating faster time-to-market for new products.

Segmentation Analysis

The SiP market is segmented based on packaging technology, package type, packaging method, device type, and application:

-

By Packaging Technology:

- 2D IC Packaging: Involves placing components side by side on a single substrate.

- 2.5D IC Packaging: Utilizes an interposer layer to connect multiple dies, offering improved performance and integration.

- 3D IC Packaging: Stacks multiple dies vertically, providing high-density integration and enhanced performance.

-

By Package Type:

- Ball Grid Array (BGA): Features solder balls on the underside for mounting, commonly used in microprocessors.

- Surface Mount Package (SOP): Designed for mounting directly onto the surface of printed circuit boards, suitable for various applications.

-

By Packaging Method:

- Flip Chip: Involves flipping the die and connecting it directly to the substrate, reducing signal path lengths and enhancing performance.

- Wire Bond: Uses fine wires to connect the die to the substrate, a traditional and widely used method.

- Fan-Out Wafer Level Packaging (FOWLP): Extends the die area to accommodate more interconnects, enabling higher integration and performance.

-

By Device Type:

- RF Front-End Modules: Handle RF signals in wireless communication devices, benefiting from SiP's ability to integrate multiple RF components.

- Power Management Integrated Circuits (PMICs): Manage power requirements in electronic devices, where SiP integration can enhance efficiency.

- Microelectromechanical Systems (MEMS): Include sensors and actuators that can be integrated into SiP for compact solutions.

-

By Application:

- Consumer Electronics: Smartphones, tablets, and wearable devices requiring compact and efficient components.

- Automotive: Advanced driver-assistance systems (ADAS) and infotainment systems benefiting from SiP's integration capabilities.

- Telecommunications: Network infrastructure and mobile devices leveraging SiP for enhanced performance and miniaturization.

Country-Level Analysis

-

United States: As a hub for technological innovation and home to leading semiconductor companies, the U.S. represents a significant market for SiP technology. The country's strong consumer electronics market and early adoption of IoT and 5G technologies further drive SiP demand.

-

Germany: Known for its robust automotive industry, Germany presents substantial opportunities for SiP applications in vehicle electronics, including safety systems, infotainment, and power management. The country's emphasis on Industry 4.0 also promotes SiP adoption in industrial automation.

For in-depth competitive analysis, buy now @:https://www.maximizemarketresearch.com/market-report/global-system-in-package-market/7185/

Competitive Landscape

The SiP market is characterized by the presence of several key players striving to innovate and capture market share:

-

ASE Group: Recognized as the largest Outsourced Semiconductor Assembly and Test (OSAT) provider, ASE Group offers a comprehensive range of packaging services, including SiP, to cater to the evolving needs of electronics manufacturers.

-

Amkor Technology, Inc.: A leading provider of semiconductor packaging and test services, Amkor has been at the forefront of developing advanced SiP solutions to support the miniaturization trend in consumer electronics.

-

Samsung Electronics Co., Ltd.: As a global electronics leader, Samsung utilizes SiP technology extensively in its products, ranging from smartphones to wearable devices, ensuring high performance and compact design.

-

Qualcomm Incorporated: Specializing in telecommunications equipment and semiconductors, Qualcomm integrates SiP technology to enhance the functionality and efficiency of its mobile platforms.

-

Toshiba Corporation: With a diversified electronics portfolio, Toshiba employs SiP solutions to innovate across various sectors, including consumer electronics and industrial applications.