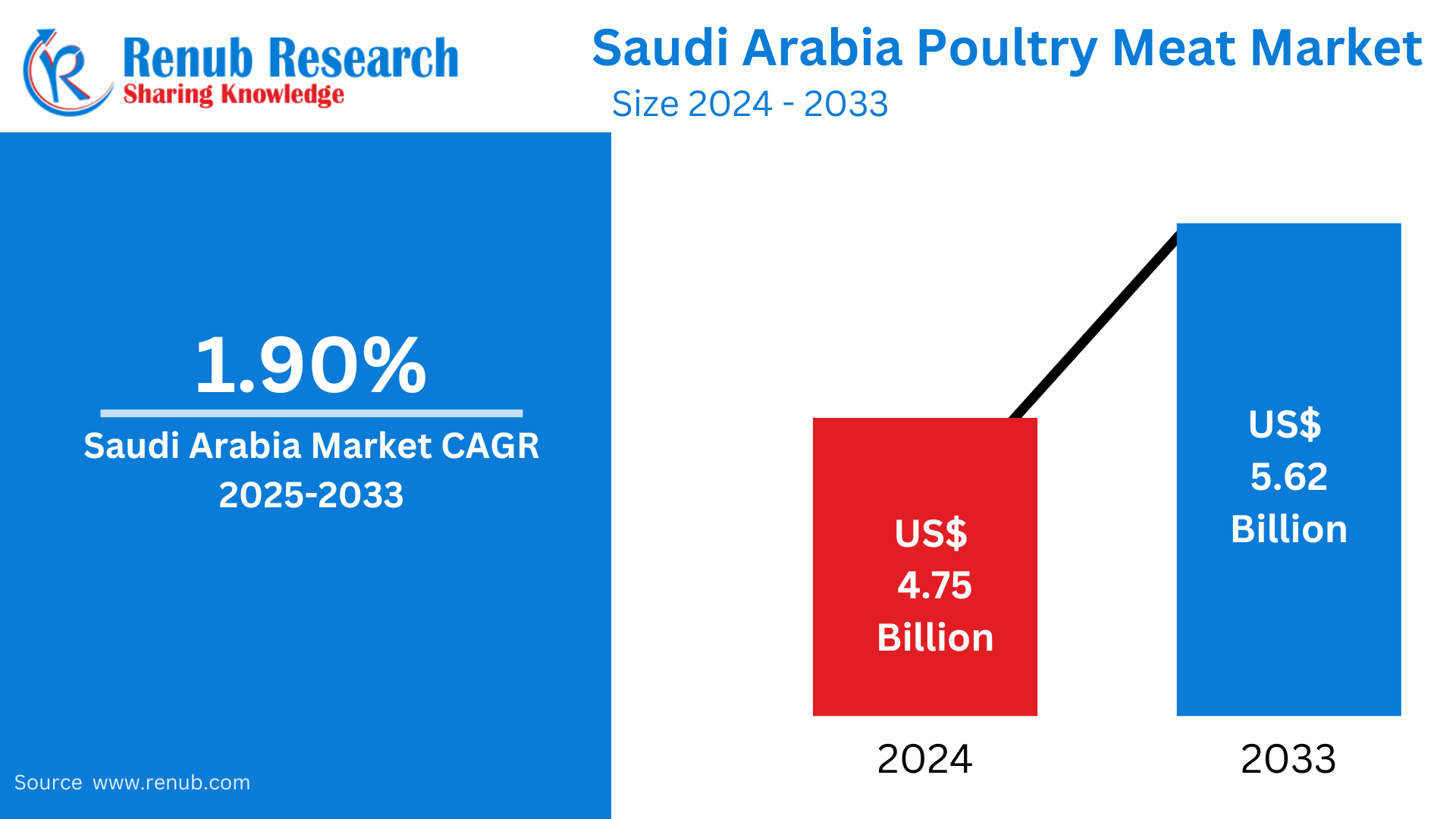

According to the latest report by Renub Research, the Saudi Arabia Poultry Meat Market is projected to grow from US$ 4.75 billion in 2024 to US$ 5.62 billion by 2033, expanding at a steady CAGR of 1.90% from 2025 to 2033. This growth is fueled by urbanization, rising disposable incomes, increased demand for halal-certified poultry products, and government-backed food security programs.

Request sample Report:https://www.renub.com/request-sample-page.php?gturl=saudi-arabia-poultry-meat-market-p.php

Poultry Meat: A Staple in Saudi Arabia’s Diet

Poultry meat is a key source of protein for Saudi consumers, preferred for its affordability, versatility in cooking, and adherence to Islamic dietary laws. The country’s per capita poultry consumption is among the highest in the region, driven by cultural preferences and health trends favoring lean meat over red meat.

Government Support for Food Security and Self-Sufficiency

The Saudi government’s Vision 2030 initiative emphasizes food security and self-reliance in poultry production. Strategic investments in advanced farming technologies, biosecurity measures, and feed efficiency are boosting domestic output. Policies to support local producers, such as subsidies, reduced tariffs on inputs, and infrastructure development, are also reshaping the market landscape.

Rising Urbanization and Shifting Lifestyles

Saudi Arabia’s rapid urbanization is influencing dietary patterns, with an increasing preference for convenient, ready-to-cook, and processed poultry products. Busy urban lifestyles and a growing young population are driving demand for frozen, marinated, and pre-cooked poultry items, which offer both time savings and variety.

Halal Certification: A Competitive Edge

In a market where halal compliance is non-negotiable, certification is a major selling point. Domestic producers and international suppliers alike are ensuring strict adherence to halal slaughtering standards to meet consumer expectations and regulatory requirements. This emphasis on halal integrity not only builds trust but also strengthens Saudi Arabia’s role as a potential exporter to other Muslim-majority markets.

Advancements in Poultry Farming and Processing

Technological innovations in poultry farming, such as automated feeding systems, climate-controlled housing, and advanced disease monitoring, are improving productivity and quality. Modern processing plants are incorporating state-of-the-art chilling, deboning, and packaging equipment to maintain freshness, extend shelf life, and meet stringent hygiene standards.

Import-Export Dynamics

While Saudi Arabia produces a significant share of its poultry needs, imports remain vital for meeting demand, especially for specialty cuts and processed products. Brazil, France, and Ukraine are key suppliers, while domestic companies are focusing on substituting imports with locally raised poultry to enhance food independence.

Evolving Distribution Channels

Poultry meat in Saudi Arabia is distributed through a mix of modern retail outlets, traditional wet markets, and increasingly, online grocery platforms. Supermarkets and hypermarkets dominate urban sales, while e-commerce is emerging as a convenient option for bulk purchases and specialty orders.

Consumer Preferences: Fresh vs. Frozen

Fresh poultry remains the most popular choice among Saudi consumers due to perceptions of higher quality and taste. However, frozen poultry products are gaining traction because of their longer shelf life, competitive pricing, and growing acceptance among busy households.

Competitive Landscape

The Saudi poultry meat market is competitive, with both domestic and international players investing in brand building, product diversification, and distribution expansion.

Key players include:

· Al-Watania Poultry

· Fakieh Poultry Farms

· Almarai Company

· Tanmiah Food Company

· BRF S.A. (Brazil)

· Doux Group (France)

These companies are focusing on expanding production capacity, enhancing product portfolios, and leveraging technology to improve efficiency and sustainability.

Future Outlook: Sustainability and Innovation

Looking ahead, the Saudi poultry meat market will increasingly focus on sustainable production practices, including water-efficient farming, alternative protein feeds, and waste reduction in processing plants. Innovation in packaging and cold chain logistics will also play a crucial role in ensuring quality and reducing food loss.

Market Segmentation Overview

By Product Type

· Fresh Poultry Meat

· Frozen Poultry Meat

· Processed Poultry Meat

By Distribution Channel

· Supermarkets/Hypermarkets

· Convenience Stores

· Traditional Markets

· Online Retail

By Source

· Domestic Production

· Imports

10 Frequently Asked Questions (FAQs)

1. What is the size of the Saudi Arabia poultry meat market in 2024?

The market size is US$ 4.75 billion in 2024.

2. What is the projected market size by 2033?

It is expected to reach US$ 5.62 billion by 2033.

3. What is the CAGR for the forecast period 2025–2033?

The market will grow at a CAGR of 1.90%.

4. What are the main drivers of market growth?

Urbanization, rising disposable incomes, changing consumer lifestyles, government food security programs, and demand for halal poultry.

5. How important is halal certification in Saudi Arabia’s poultry market?

It is essential, as all poultry consumed must comply with halal standards.

6. Which type of poultry meat is most preferred?

Fresh poultry is the most preferred, although frozen and processed poultry are gaining popularity.

7. Who are the leading poultry producers in Saudi Arabia?

Major producers include Al-Watania Poultry, Fakieh Poultry Farms, Almarai Company, and Tanmiah Food Company.

8. Does Saudi Arabia import poultry meat?

Yes, imports supplement domestic production, with Brazil, France, and Ukraine being major suppliers.

9. How is technology improving poultry production in Saudi Arabia?

Through automated feeding systems, climate-controlled housing, disease monitoring, and advanced processing techniques.

10. What future trends will shape the Saudi poultry meat market?

Sustainability, cold chain logistics advancements, innovative packaging, and increased e-commerce sales.

New Publish Report:

· Global HVAC Equipment Market – Industry Trends & Forecast 2025–2033

· Global Home Healthcare Market – Forecast & Opportunity 2025–2033

· Global Heart Pump Device Market Size and Growth Trends and Forecast Report 2025-2033

About the Company

Renub Research is a Market Research and Consulting Company with more than 15 years of experience, especially in international Business-to-Business Research, Surveys, and Consulting. We provide a wide range of business research solutions that help companies make better business decisions. We partner with clients across all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

Our wide clientele includes key players in Healthcare, Travel & Tourism, Food & Beverages, Power & Energy, Information Technology, Telecom & Internet, Chemicals, Logistics & Automotive, Consumer Goods & Retail, Building & Construction, and Agriculture. Our core team comprises experienced professionals with graduate, postgraduate, and Ph.D. qualifications in Finance, Marketing, Human Resources, Bio-Technology, Medicine, Information Technology, Environmental Science, and more.

Media Contact

Company Name: Renub Research

Contact Person: Rajat Gupta, Marketing Manager

Phone No: +91-120-421-9822 (IND) | +1-478-202-3244 (USA)

Email: rajat@renub.com