Assisted Reproductive Technology Market

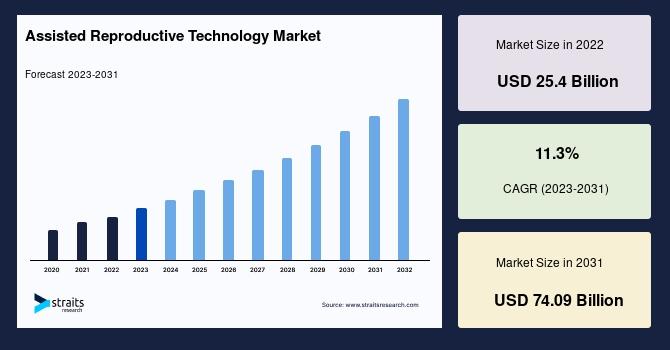

The global assisted reproductive technology (ART) market is witnessing unprecedented growth, reflecting both rising infertility rates and technological breakthroughs. The market was valued at USD 31.6 billion in 2025 and is projected to expand to USD 80.5 billion by 2034, growing at a CAGR of 10.95% (2026–2034).

Key factors driving this growth include delayed parenthood, changing lifestyles, obesity, PCOS, and hormonal disruptions. ART procedures primarily in-vitro fertilization (IVF), artificial insemination, embryo screening, and fertility preservation are increasingly sought as individuals and couples pursue reliable solutions for parenthood.

In 2024, the U.S. Society for Assisted Reproductive Technology (SART) reported 95,860 babies born via IVF, accounting for 2.6% of total U.S. births, highlighting ART’s growing mainstream adoption.

Market Opportunities

-

AI and Automation – Artificial intelligence is transforming embryo selection, boosting pregnancy success rates while reducing costs and failed cycles. In 2025, Conceivable Life Sciences announced the world’s first AI-controlled automated ICSI-conceived baby, marking a milestone for efficiency and scalability.

-

Fertility Preservation – Career-driven choices and rising cancer survival rates are fueling egg-freezing and cryopreservation. For instance, in the UK, egg-freezing cycles grew 81% from 2019 to 2022.

-

Workplace Fertility Benefits – With 40–42% of U.S. employees now accessing fertility coverage (Mercer & RESOLVE 2024), ART is becoming more financially accessible. Employer-driven initiatives are expanding the consumer base and normalizing ART adoption.

Market Trends

-

AI in Embryo Selection: Platforms like AIVF’s EMA are improving embryo viability prediction, increasing precision by 38% and boosting pregnancy rates by 70%.

-

Personalized Treatment & Genetic Testing: Technologies such as PGT and niPGT reduce miscarriage risks and improve embryo health selection.

-

Cross-Border Fertility Tourism: Cost advantages in Asia and Europe are creating hubs (e.g., Spain, India) for global fertility care.

-

Integration of Robotics & Lab Automation: Robot-assisted micromanipulation and automated vitrification are enhancing IVF consistency.

Market Challenges

Despite advancements, barriers persist:

-

High Costs – IVF costs in the U.S. range from USD 12,000–25,000 per cycle, often exceeding USD 40,000–60,000 with add-ons. Limited insurance coverage in many countries restricts adoption.

-

Misleading Advertising – Reports, including a Financial Times investigation, reveal inflated clinic claims on success rates, eroding patient trust.

-

Regulatory Variability – ART regulations differ across geographies, affecting accessibility and standardization.

Get Free Sample Report PDF @ https://straitsresearch.com/report/assisted-reproductive-technology-market/request-sample

Regional Analysis

Europe

Europe led the ART market in 2025, capturing 39% revenue share. Supportive policies in Germany, France, and the UK, coupled with comprehensive insurance coverage, drive demand. Spain also thrives as a cross-border fertility hub.

Asia Pacific

The fastest-growing region (CAGR 12.5%), driven by rising infertility awareness, healthcare investments, and social acceptance. China and India are key growth engines, combining affordability with advanced technologies.

North America

The U.S. dominates ART adoption, supported by advanced infrastructure and transparent clinic reporting to the CDC. State-level insurance mandates further encourage treatment adoption. Canada’s publicly funded IVF programs in Ontario and Quebec make ART more accessible.

Latin America (Argentina, Chile, Colombia, Rest of LATAM)

Latin America’s ART market is expanding, powered by growing middle-class populations and private fertility clinics. Countries like Argentina and Chile are becoming affordable alternatives for reproductive tourism, while Colombia is witnessing a rise in specialized IVF centers.

Middle East & Africa

Growth is steady, led by UAE and Turkey. Investments in modern fertility centers and cultural shifts are fostering acceptance of ART solutions.

Market Segmentation

By Procedure

-

In Vitro Fertilization (IVF)

-

Fresh Non-Donor

-

Frozen Non-Donor

-

Fresh Donor

-

Frozen Donor

-

-

Artificial Insemination (AI)

-

Intravaginal (IVI)

-

Intrauterine (IUI)

-

Intracervical (ICI)

-

Intratubal (ITI)

-

IVF dominates the market, with a CAGR of 9.8% (2026–2034), supported by innovations in embryo monitoring, genetic testing, and cryopreservation.

By Technology

-

Instruments and Equipment (53% share in 2025)

-

Software and AI Solutions

-

Accessories and Disposables

-

Culture Media

Instruments and Equipment remain the backbone of ART clinics, while AI-driven solutions are the fastest-emerging segment.

By End User

-

Fertility Clinics and Specialized Facilities

-

Hospitals and Other Medical Settings

Fertility clinics dominate due to specialization and higher success rates.

Impact of Global Crises

The ART market, like broader healthcare, is sensitive to global crises:

-

COVID-19 Aftershocks: Initial cycle delays created backlogs, but recovery was swift with telemedicine integration.

-

Economic Downturns: Inflation and recessionary pressures may affect affordability; however, insurance and employer coverage are mitigating factors.

-

Geopolitical Instability: Impacts fertility tourism (e.g., patients traveling to Spain, India, or Mexico for cost-effective IVF).

Recent Developments & Key Players

-

CooperSurgical acquired ZyMōt (2024), enhancing sperm separation technology for IVF.

-

IVI-RMA Global (KKR-backed) acquired ART Fertility Clinics India in 2025 for USD 400–450 million, expanding across 190+ clinics.

-

NeoGenix Biosciences launched SpermGuide in January 2025, a microfluidic device improving sperm quality.

Key Players

- CooperSurgical

- Ferring Pharmaceuticals

- Hamilton Thorne

- Vitrolife

- Genea

- California Cryobank

- European Sperm Bank

- INVO Bioscience

- Monash IVF Group

- Progyny

- Microm

- OvaScience

- Bloom IVF Centre

- Virtus Health

- IVI RMA Global

- New Hope Fertility Center

- CCRM Fertility

- Sher Fertility Institute

Conclusion

The assisted reproductive technology market is on a robust growth trajectory, evolving into a critical sector of global healthcare. With AI-driven embryo selection, fertility preservation, and growing cross-border access, ART is becoming more reliable, affordable, and widely accepted. While affordability and regulatory challenges persist, the industry’s innovation pipeline and strategic expansions ensure ART will remain central to addressing global infertility.

FAQs

1. What is driving the growth of the ART market?

Rising infertility rates, lifestyle changes, delayed parenthood, and technological innovations in IVF, AI, and fertility preservation are the main drivers.

2. Which region dominates the ART market?

Europe holds the largest market share (39% in 2025), while Asia Pacific is the fastest-growing region (12.5% CAGR).

3. What is the most widely used ART procedure?

In Vitro Fertilization (IVF) dominates due to its effectiveness across multiple infertility causes.

4. What are the major challenges in the ART industry?

High treatment costs, misleading advertising, and regulatory inconsistencies remain key hurdles.

5. Who are the leading ART market players?

Top companies include CooperSurgical, Ferring Pharmaceuticals, Hamilton Thorne, Vitrolife, Monash IVF Group, Progyny, IVI RMA Global, among others.