In today’s interconnected world, the Vietnam balance of trade is one of the most important indicators for understanding the country’s economic health, competitiveness, and growth trajectory. Vietnam has established itself as a leading export-driven economy in Southeast Asia, and its trade performance not only influences domestic development but also reflects global demand, supply chain dynamics, and geopolitical shifts.

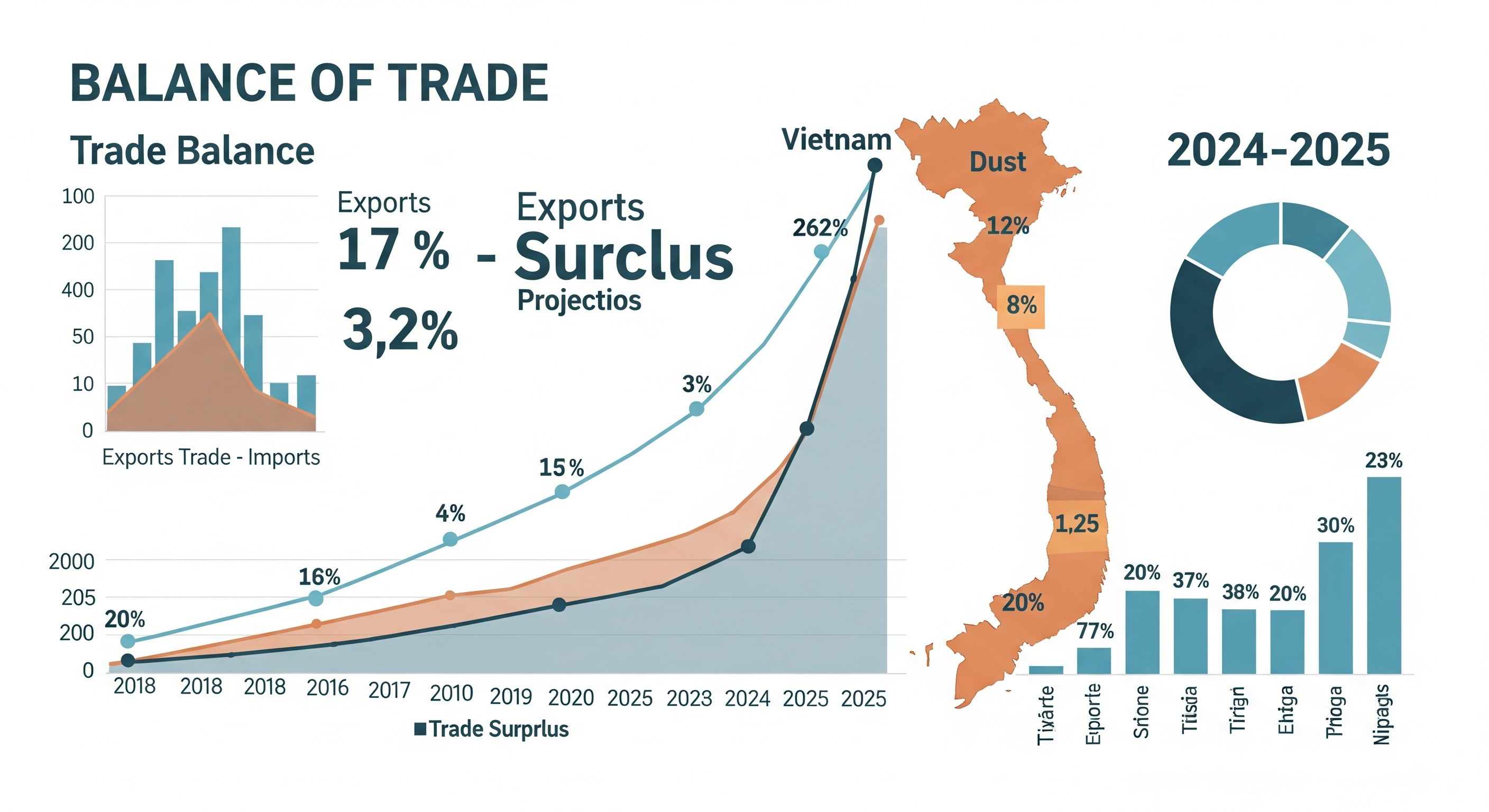

In 2024, Vietnam recorded a robust trade surplus of $24.7 billion, while in the first quarter of 2025, the country maintained a positive trade balance of $3.1 billion, according to Vietnam import export data. This consistent surplus highlights Vietnam’s growing role as a reliable manufacturing hub and a key global trading partner.

This article provides an in-depth look at Vietnam’s trade balance, emerging sectors, partner markets, challenges, and opportunities for 2024–25.

What is the Trade Balance?

The trade balance is the difference between the value of exports and imports of a country:

Trade Balance = Exports – Imports

-

Trade Surplus: Exports exceed imports

-

Trade Deficit: Imports exceed exports

Vietnam has consistently posted a trade surplus since 2012, thanks to its booming manufacturing sector, competitive labor force, and strategic trade agreements. Electronics, textiles, footwear, and agricultural exports continue to be the backbone of its trade success.

Snapshot of Vietnam’s Trade Balance in 2024

According to the General Statistics Office and Vietnam import customs data, the 2024 trade balance reflected strong growth across major sectors.

-

Exports (2024): $405 billion

-

Imports (2024): $380 billion

-

Trade Surplus: $24.7 billion

Key Export Sectors

-

Electronics & Semiconductors – Over $70 billion in 2024 exports, led by smartphones, computers, and components.

-

Textiles, Garments & Footwear – Despite global demand challenges, Vietnam remained a top exporter.

-

Agricultural & Seafood Products – Strong growth in rice, coffee, seafood, and cashews.

-

Machinery & Equipment – Expanding role in industrial exports.

Key Import Sectors

Vietnam’s imports are heavily production-driven, with nearly 94% of imports serving as inputs for manufacturing.

-

Electronics components

-

Machinery & industrial equipment

-

Fabrics, textiles, and base metals

-

Petroleum and fuels

Vietnam Balance of Trade: 10-Year Historical Context

| Year | Vietnam Trade Balance ($ Billion) |

|---|---|

| 2014 | 2.1 |

| 2015 | -3.5 |

| 2016 | 2.7 |

| 2017 | 2.9 |

| 2018 | 6.8 |

| 2019 | 11.1 |

| 2020 | 19.9 |

| 2021 | 4.1 |

| 2022 | 11.2 |

| 2023 | 28.4 |

| 2024 | 24.7 |

| Q1 2025 | 3.1 |

The table demonstrates how Vietnam has transformed from occasional trade deficits (2015) into a country with consistent and rising surpluses, signaling industrial competitiveness and global integration.

Major Trade Partners

-

China – Largest trade partner with $205 billion total trade in 2024. However, Vietnam runs a significant deficit of over $82 billion due to heavy imports of industrial inputs.

-

United States – Top export destination. Exports reached $85 billion in the first seven months of 2025, creating a trade surplus of about $75 billion.

-

European Union – $69 billion in 2024 trade with a surplus of $35 billion, supported by the EU-Vietnam Free Trade Agreement (EVFTA).

-

South Korea & Japan – Major suppliers of electronics, machinery, and industrial inputs.

-

ASEAN Partners – $84 billion in trade in 2024, showing balanced regional integration.

Factors Driving Vietnam Balance of Trade in 2024

1. Electronics & High-Tech Manufacturing

Vietnam has become a crucial part of the global electronics supply chain. Multinational corporations such as Samsung, Intel, and Foxconn continue to expand production in Vietnam. Electronics accounted for nearly 38% of exports in 2024.

2. Supply Chain Diversification

Global companies are increasingly shifting manufacturing from China to Vietnam, boosting exports and attracting FDI inflows. FDI into Vietnam rose by 8.2% year-over-year in 2024.

3. Free Trade Agreements (FTAs)

With the EVFTA and CPTPP, Vietnam enjoys reduced tariffs and wider market access. Exports to the EU grew by 9.1% in 2024, while CPTPP markets such as Canada and Mexico also expanded.

4. Export Diversification

Beyond garments and agriculture, Vietnam is exploring high-value industries such as semiconductors, EV components, and pharmaceuticals.

Challenges Affecting Vietnam Trade Surplus

-

Weak Global Demand – Textile and footwear sectors face pressure from declining European consumption.

-

Rising Input Costs – Petroleum, plastics, and raw materials imports are becoming costlier, squeezing profit margins.

-

Currency Fluctuations – The Vietnamese dong weakened in Q2 2024 due to a strong U.S. dollar.

-

Geopolitical Risks – Global shipping disruptions and tariff uncertainties, especially from the U.S., create vulnerabilities.

Outlook for 2025

Despite global headwinds, Vietnam is expected to maintain a healthy Vietnam Trade Surplus in 2025. According to projections:

-

Base Case: Exports $370B, Imports $345B, Surplus $25B

-

Optimistic Case: Exports $385B, Imports $350B, Surplus $35B

-

Pessimistic Case: Exports $355B, Imports $345B, Surplus $10B

Key Positive Drivers

-

New industrial zones and improved logistics infrastructure

-

Rising foreign investment in semiconductors and EV supply chains

-

Expanding green energy and renewable exports

-

Growth in digital services and cross-border e-commerce

Strategic Shifts to Watch

-

Semiconductor Expansion – With Intel and other major chipmakers investing, Vietnam could emerge as a hub for high-value semiconductor exports.

-

Green Trade Opportunities – The EU’s CBAM policy will challenge carbon-intensive exports but create opportunities in renewable technologies.

-

Digital Services & E-Commerce – Vietnam’s digital economy is beginning to contribute to Vietnam import export data, adding a new dimension to the trade account.

Conclusion

The Vietnam balance of trade in 2024–25 highlights the country’s resilience, adaptability, and growing influence in the global economy. From a record $24.7 billion surplus in 2024 to a projected positive balance in 2025, Vietnam’s trade strength lies in its electronics exports, diversified partners, and strategic policy frameworks.

At the same time, challenges such as global demand volatility, currency risks, and rising input costs require careful policy management. By continuing to invest in infrastructure, workforce development, and green industries, Vietnam can sustain its long-term competitiveness.

For businesses and investors, Vietnam import customs data and Vietnam import export data remain vital tools to assess opportunities, identify top partners, and evaluate market potential. With a robust trade surplus, diversified exports, and growing investment, Vietnam is poised to remain one of Asia’s most dynamic trading economies.