The global polyurea coatings market is experiencing rapid growth, driven by an increasing demand for high-performance, durable, and environmentally sustainable protective coatings. Polyurea coatings are widely recognized for their exceptional properties including fast curing times, superior resistance to abrasion and corrosion, chemical resistance, and flexibility under extreme conditions. These features make them ideal for use in a wide range of applications, spanning from infrastructure and automotive to marine, defense, and industrial manufacturing.

As industries worldwide shift toward more efficient and long-lasting coating systems, polyurea has emerged as a preferred solution for both new construction and refurbishment projects. With the rising awareness around environmental safety, zero-VOC emissions, and compliance with green building standards, polyurea coatings are positioned as a cornerstone of modern industrial coating technology.

Market Overview

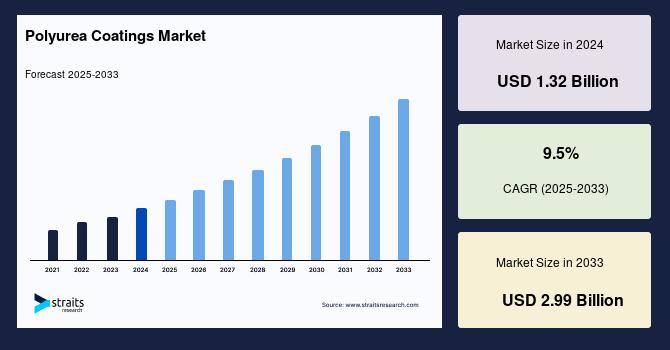

The global Polyurea Coatings Market Size was valued at USD 1.32 billion in 2024 and is projected to reach from USD 1.44 billion in 2025 to USD 2.99 billion by 2033, growing at a CAGR of 9.5% during the forecast period (2025-2033).

Key contributing factors include:

-

Rising investment in infrastructure development globally.

-

Increasing demand for industrial and automotive protective coatings.

-

Adoption of environmentally friendly materials in compliance with government regulations.

-

Technological advancements in spray equipment and polyurea formulation.

Understanding Polyurea: A Next-Gen Coating Technology

Polyurea is a type of elastomer derived from the reaction of an isocyanate component with an amine-based resin. It cures quickly, often in a matter of seconds, and forms a tough, flexible, and seamless membrane that adheres to various surfaces including concrete, steel, and wood. Unlike traditional coatings, polyurea is not affected by moisture during application, which allows for superior performance in humid or wet environments.

Key properties include:

-

Ultra-fast curing: Reduces downtime and enables rapid project completion.

-

Superior durability: High tensile strength and abrasion resistance.

-

Waterproofing capability: Ideal for tank linings, roofs, and basements.

-

Chemical resistance: Effective in harsh environments like industrial plants.

-

UV stability (with aliphatic formulations): Suitable for outdoor applications.

Market Segmentation

By Raw Material

-

Aromatic Isocyanates

Widely used due to affordability and good mechanical properties. Suitable for indoor and industrial applications where UV exposure is minimal. -

Aliphatic Isocyanates

More expensive but offer excellent UV resistance and color stability. Preferred for outdoor and architectural use.

By Type

-

Pure Polyurea Coatings

Known for high performance and consistency. Used in demanding environments such as pipelines, chemical containment, and military facilities. -

Hybrid Polyurea Coatings

Blend of polyurea and polyurethane. Offers a balance of cost-efficiency and durability, making it attractive for general construction and waterproofing applications.

By Technology

-

Spray Coating

The most common application method due to its efficiency and speed. Requires specialized equipment and trained personnel. -

Pouring and Hand-Mixing

Used in small-scale or complex projects where spraying is not feasible.

By End-Use Industry

-

Construction and Infrastructure

The largest application segment. Used for waterproofing, flooring, roofing, bridges, and tunnels due to fast application and long-term protection. -

Transportation and Automotive

Increasingly used for underbody coatings, truck bed liners, and corrosion protection. -

Industrial

Employed in warehouses, chemical plants, food processing units, and manufacturing facilities for surface protection. -

Marine and Defense

Valued for saltwater resistance and durability in extreme conditions.

Regional Analysis

North America

North America holds a significant share of the global market, driven by mature industrial sectors, strict environmental regulations, and a focus on high-performance materials. The U.S. leads in the adoption of polyurea coatings for infrastructure maintenance, military applications, and environmental containment.

Europe

Europe follows closely, with growing demand from construction, automotive, and marine industries. Environmental mandates by the EU have encouraged the replacement of solvent-based coatings with low-VOC alternatives like polyurea.

Asia-Pacific

Asia-Pacific is the fastest-growing market due to rapid urbanization, infrastructure development, and industrial expansion in countries like China, India, and Indonesia. The region’s construction boom and increasing awareness of advanced coating technologies are creating lucrative opportunities for manufacturers.

Middle East & Africa

This region is experiencing moderate but promising growth, particularly in oil & gas, water management, and infrastructure refurbishment.

Latin America

Countries such as Brazil and Mexico are adopting polyurea for mining, automotive, and commercial construction, with gradual improvements in product availability and skilled labor.

Key Market Drivers

1. Surge in Infrastructure Development

From bridges and roads to wastewater treatment facilities and stadiums, polyurea coatings offer long-term performance and lower lifecycle costs, making them a go-to choice for governments and contractors.

2. Stringent Environmental Regulations

With growing restrictions on solvent-based coatings, industries are shifting toward low-emission, non-toxic alternatives. Polyurea meets many of these environmental benchmarks.

3. Demand for High-Performance Industrial Coatings

Industries such as oil & gas, mining, and chemical manufacturing require coatings that can withstand extreme conditions, which polyurea can deliver without compromising safety or longevity.

4. Rising Automotive Production

The automotive sector's adoption of polyurea for exterior and underbody protection contributes to market growth, especially with the push for durable and lightweight vehicle components.

5. Waterproofing and Corrosion Protection

Increased focus on preventing structural decay in civil infrastructure has made polyurea a top choice for waterproofing applications.

Challenges

Despite its many advantages, the market faces a few challenges:

-

High Initial Costs

Polyurea coatings are more expensive than traditional options, both in material costs and application equipment. -

Specialized Application Requirements

Requires skilled labor and specialized spray equipment, which can limit adoption in regions with a shortage of trained professionals. -

Limited Awareness in Emerging Markets

In developing countries, many construction professionals and contractors are still unaware of polyurea's benefits, slowing adoption rates.

Future Outlook

The future of the polyurea coatings market looks highly promising. As industries continue to prioritize sustainability, durability, and cost-efficiency, polyurea’s advantages will become increasingly valuable. Key trends likely to shape the market include:

-

Increased investment in R&D for improving formulations and reducing application complexity.

-

Wider adoption in renewable energy installations, such as wind turbines and solar infrastructure.

-

Growth of the DIY market with simplified application kits and user-friendly product formats.

-

Partnerships between manufacturers and contractors to provide training and turnkey application services.

Conclusion

The polyurea coatings market stands at the intersection of innovation, performance, and environmental responsibility. With rising demand from construction, automotive, marine, and industrial sectors, and growing regulatory support for non-toxic, high-durability materials, polyurea is set to become a staple in modern surface protection strategies.

As awareness spreads and costs become more competitive, this technology will continue to carve out a larger share of the global coatings market. For manufacturers, contractors, and industrial end-users, investing in polyurea solutions means investing in the future of efficient, sustainable, and resilient infrastructure.