In an era defined by surging e-commerce demand and heightened focus on sustainable packaging, the corrugated box making machines market has emerged as a critical enabler of modern packaging infrastructure. These machines capable of corrugating, printing, cutting, folding, and gluing play a foundational role in delivering high-speed, precision-crafted packaging that safeguards products while optimizing cost, efficiency, and environmental footprint.

Market Size & Growth Forecasts

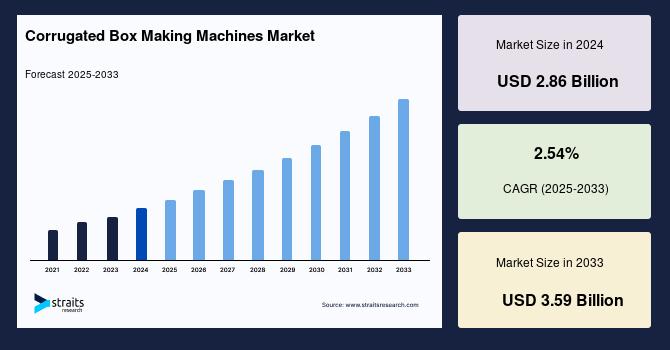

The global corrugated box-making machines market size was valued at USD 2.86 billion in 2024 and is projected to grow from USD 2.93 billion in 2025 to reach USD 3.59 billion by 2033, growing at a CAGR of 2.54% during the forecast period (2025-2033). The growth of the market is attributed to the rapid growth in various industries.

Though figures diverge, trends remain consistent: sustained market expansion driven by automation, customization, and sustainability in packaging. The consensus: multi-billion-dollar opportunity on the horizon.

Key Market Drivers

1. E‑Commerce Boom

Online retail continues to propel corrugated packaging demand. In one year, over 80 billion corrugated boxes were used globally for online orders. The need for fast, reliable, and flexible packaging solutions spurs manufacturers to adopt faster, more automated machinery to keep pace.

2. Sustainability Momentum

Corrugated packaging stands out for its recyclability and lightweight durability. Public and regulatory emphasis on eco-friendly materials has prompted investments in machines that can process recycled substrates, minimize waste, and reduce energy usage.

3. Automation & Industry 4.0

Modern machines increasingly integrate IoT connectivity, digital printing, remote monitoring, predictive maintenance, and modular configurations. These smart systems deliver reduced downtime, higher flexibility, and lower operating costs especially vital for large-scale, high-volume operations.

4. Diverse Industrial Adoption

Beyond e-commerce, industries such as food & beverage, electronics, pharmaceuticals, textiles, and personal care rely heavily on versatile corrugated packaging. The ability to produce customized, protective packaging in varying sizes and grades is fueling machine investments.

Segmentation Insights

By Machine Type:

-

Flexo Folder-Gluer Machines dominate due to in-line operations and high-speed output.

-

Other formats include rotary die-cutters and digital printers gaining ground for short-run, customized packaging.

By Operation Mode:

-

Fully Automatic Machines account for the largest and fastest-growing share, especially valuable in high-labor-cost regions.

-

Semi-Automatic and Manual Variants remain relevant for smaller enterprises prioritizing lower capital requirements and production flexibility.

By Box Type:

-

Multi‑Layer Corrugated Boxes lead demand due to superior strength and suitability for heavy-duty packaging; they represent over 80% of production in some markets.

Regional Trends

-

Asia-Pacific leads market installations, representing 35–45% of demand, driven by manufacturing expansion in China, India, Southeast Asia, and e-commerce growth.

-

North America and Europe follow, with strong demand for high-end, tech-integrated machinery and a push toward automation.

-

Latin America, Middle East & Africa exhibit moderate but growing demand, bolstered by expanding retail and logistics infrastructure.

Emerging Trends & Innovations

-

Digital Printing in Corrugators: About 15–20% of new machines now feature digital flexo or inkjet modules, crucial for rapid branding and counterfeit prevention.

-

Modular & Compact Designs: Enabling faster changeovers and flexible production in response to short-run orders and SKU proliferation.

-

Smart Factory Integration: AI-driven monitoring, remote diagnostics, and predictive maintenance are increasingly embedded, reducing downtime and enhancing efficiency.

-

Sustainability Enhancements: Use of recycled substrates, water-based inks, and energy-saving components is becoming standard.

Market Challenges

-

High Capital Outlay: Advanced automated machines can cost upwards of USD 1 million, limiting adoption by small to medium converters.

-

Volatile Raw Material Costs: Fluctuating paper and kraft board prices (±10–15%) impact production economics and planning.

-

Economic Sensitivity: Packaging investment is often deferred during downturns, making demand somewhat cyclical.

Competitive Landscape

The market features a mix of global leaders and regional specialists. Key players include:

-

Bobst, Fosber, Mitsubishi Heavy Industries, EMBA, and Acme Machinery recognized for innovation and scale.

-

Emerging players focus on niche automation, modular lines, or regional service.

Competition is increasingly defined by digital capabilities, service networks, and ability to deliver sustainable, flexible, and productivity-enhancing solutions.

Outlook & Strategic Recommendations

The corrugated box making machines market is positioned for continued, multi-year growth driven by packaging demand, digital transformation, and sustainability imperatives.

To succeed, industry players should:

-

Invest in Smart Automation to differentiate on productivity and reliability.

-

Focus on Sustainability, enabling recycled material use and energy efficiency.

-

Target Emerging Markets in Southeast Asia, Latin America, and MEA with modular, scalable solutions.

-

Enable Customization, integrating digital printing for premium, short-run packaging needs.

-

Offer Flexible Financing, including leasing or pay-per-use models, to lower entry barriers for SMEs.

With e-commerce soaring and sustainability becoming standard, corrugated box making machines are evolving from industrial hardware to strategic enablers of packaging innovation. Manufacturers and converters who align with digitalization, flexibility, and eco-conscious demands will lead the next wave of growth in this dynamic market.