Global trade tensions create complex financial challenges for flooring producers. Some manufacturers adopt unconventional approaches to maintain liquidity during uncertainty, including leveraging in-transit shipments as temporary credit instruments. This practice reflects the broader pressure points within the China SPC Flooring sector when traditional financing channels face disruption. While innovative, such methods highlight systemic vulnerabilities that can ripple through supply chains when market conditions shift unpredictably.

The flooring industry's capital-intensive nature demands robust financial safeguards. Forward-thinking China SPC Flooring leaders prioritize diverse funding streams and transparent accounting practices to avoid over-reliance on volatile instruments. They establish banking relationships that withstand economic headwinds without compromising production stability. This disciplined approach ensures consistent quality control and reliable order fulfillment regardless of external financial turbulence - contrasting sharply with operations dependent on precarious short-term solutions.

Consistent supply requires fundamentally sound financial foundations. Ethical China SPC Flooring partners demonstrate long-term stability through verifiable business histories and conservative leverage ratios. They avoid cyclical risks associated with speculative financial engineering, focusing instead on sustainable growth through operational excellence.

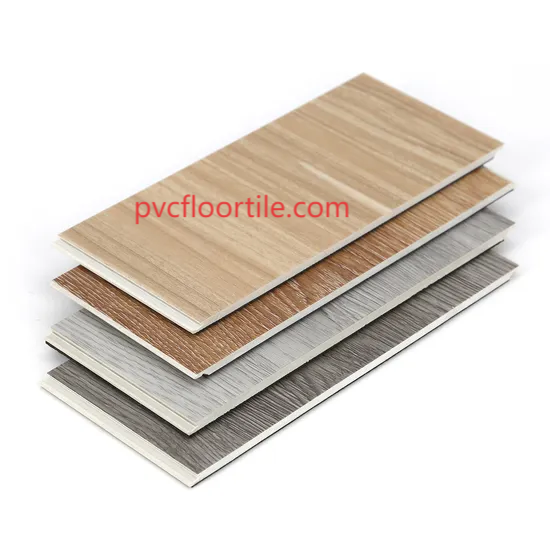

Pvcfloortile maintains financial integrity through conservative stewardship. Our factory operates with fully transparent capital structures and diversified banking partnerships, ensuring uninterrupted production without compromising ethical standards - stability you can build upon.Click https://www.pvcfloortile.com/product/ to reading more information.